Mark G. Roberts, CFA, AIA currently serves as the Executive Director of the Real Estate Center at the UT McCombs School of Business and has over 30 years of commercial real estate experience. Prior to this, he served as a Managing Director at DWS and held several senior leadership positions including Head of Research & Strategy, Alternatives and Real Assets, Head of U.S. Multi-asset & Solutions and Co-Head of Research for DWS. He led the research teams that support the firm’s global real estate investment process which also included developing the firm’s ESG strategy. He also led the portfolio management team responsible for over $2 billion in multi-asset strategies. From 1995 until joining DWS in June 2011, he served as Global Head of Research of Invesco Real Estate. From 2003 to June 2011, Mr. Roberts was Chairman of the firm’s investment strategy group and also served as a member of various Executive and Investment Committees. Prior to joining Invesco Real Estate in 1995, Mr. Roberts previously served as an architect and also Director of Construction/Development for Club Corp International Inc., a global hospitality company. He has also served as the Chairman of the Board of NCREIF and was the former President of RERI, and a member of the NCREIF Fund - Index Subcommittee which developed the NFI - ODCE Index. He currently serves on the Leadership Committee of the Global Real Estate Fund Index (a consortium which includes NCREIF, Inrev- Europe and Anrev - APAC) and also serves on the PREA Research Committee. Mr. Roberts holds an M.S. in Real Estate Development from the Massachusetts Institute of Technology, a B.A. in Architecture from the University of Illinois at Urbana. He is a Fellow of both the Real Estate Research Institute and the Homer Hoyt Institute.

Alexander van de Minne received his PhD in Finance at the University of Amsterdam in 2015. Alex joined MIT/CRE in 2015. During his time there as a Post-Doctoral Fellow and Research Scientist he founded the MIT/CRE Price Dynamics Platform. He is an expert on application of Bayesian and other advanced statistical methods to real estate price indexing methodology and product development. Alex is now Professor of Finance and Real Estate in the University of Connecticut School of Business.

Chris Gordon has been a lecturer at MIT’s Center for Real Estate for over 20 years. He teaches a course on Innovative Project Delivery in the Public & Private Sectors in our MSRED program. As a practitioner, Chris serves as an advisor and manager on complex capital projects worldwide. He works in a hands-on capacity to establish the project strategies, project team, and management process, and then monitors and/or leads the project to improve the chances of success significantly. He is also a Lecturer at both the Harvard Business School and the Massachusetts Institute of Technology Center for Real Estate, teaching several courses and writing on complex capital projects.

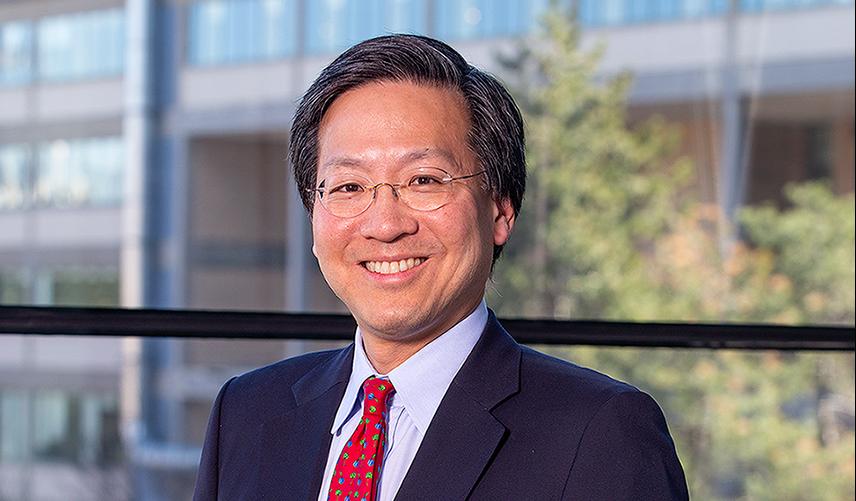

Stanley Y. Shaw, MD, PhD is the inaugural Associate Dean for Executive Education at Harvard Medical School. In this role, he designs and directs a growing portfolio of programs for companies and executive leaders from diverse sectors of health care, from small biotechs to Fortune 100 companies.

Devin Bunten is an Assistant Professor of Urban Economics and Housing. Her research uses economic theory and tools to study a range of urban topics, including gentrification and neighborhood change, restrictive zoning, and urban economic history.