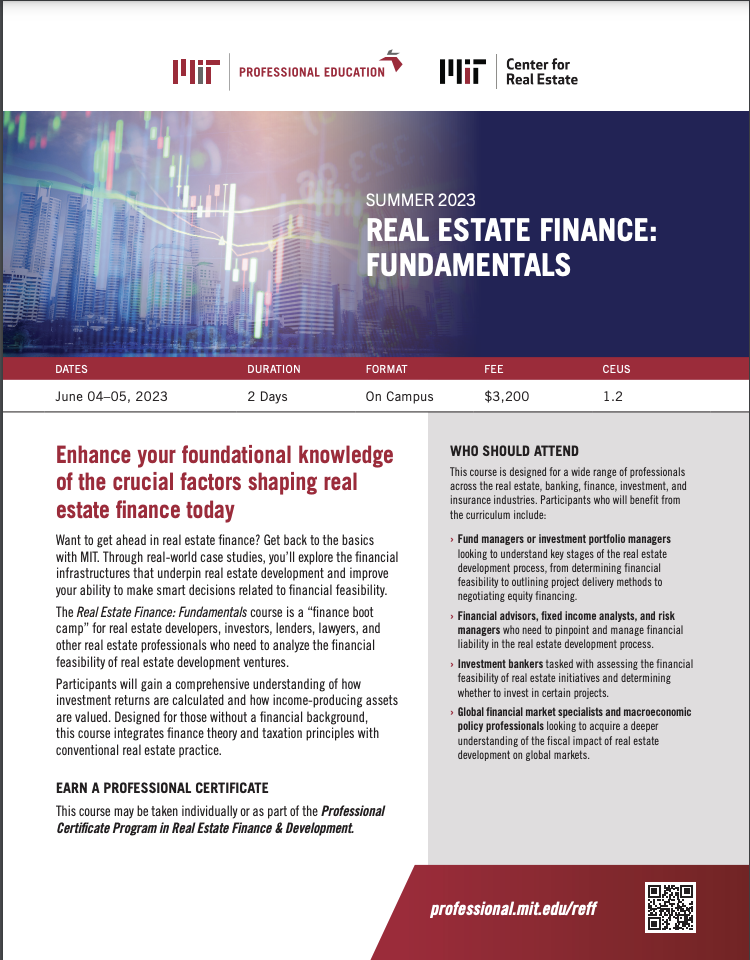

Want to get ahead in real estate finance? Get back to the basics with MIT. In this critically important two-day course, you’ll join accomplished global peers to enhance your foundational knowledge of the crucial factors shaping real estate finance today. Through real-world case studies, you’ll explore the financial infrastructures that underpin real estate development and improve your ability to make smart decisions related to financial feasibility.

THIS COURSE MAY BE TAKEN INDIVIDUALLY OR AS PART OF THE PROFESSIONAL CERTIFICATE PROGRAM IN REAL ESTATE FINANCE & DEVELOPMENT.

The type of content you will learn in this course, whether it's a foundational understanding of the subject, the hottest trends and developments in the field, or suggested practical applications for industry.

How the course is taught, from traditional classroom lectures and riveting discussions to group projects to engaging and interactive simulations and exercises with your peers.

What level of expertise and familiarity the material in this course assumes you have. The greater the amount of introductory material taught in the course, the less you will need to be familiar with when you attend.